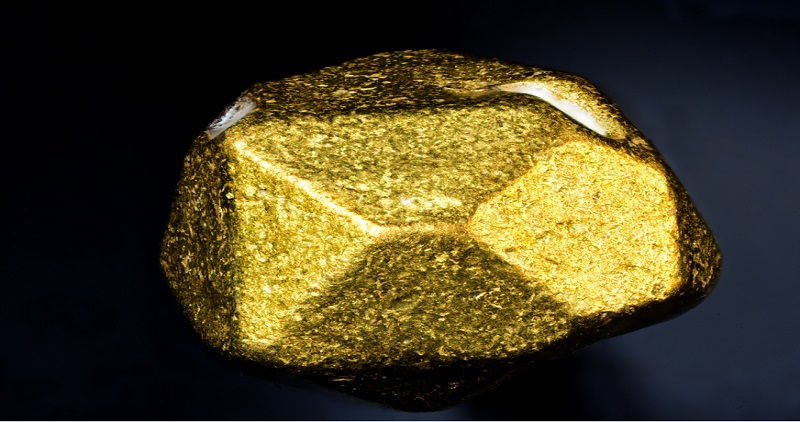

Gold Investment Package

Gold has stood the test of time as a reliable store of wealth, especially in unstable times. In fact, the “gold standard” was based on tangible value – arguably the same trusted value that gold, silver, platinum and palladium still have today.

Remember: A golden retirement starts with gold.

Some experts say you should guard against today’s volatile economic environment by lining your retirement and savings nest egg with gold and other precious metals. Here are some reasons you could consider including gold and other precious metals in your asset portfolio

Just in the course of the 21st century, the price of gold has risen 300%, while the purchasing power of the dollar has declined by more than 25%During inflation currencies can lose value, while precious metals have historically retained value.Gold bullion is often seen as a potential hedge against inflation.The value of precious metals is recognized across most cultures and geographies, making it essentially a borderless currency.Help protect your wealth from economic crises, governments printing money, and uncertain times.Precious metals are prized for their rarity and beauty today, as they have been throughout recorded history.

Mirvac Limited offers the expertise to help you make smart decisions about obtaining precious metals products and about building a diverse asset portfolio. We will help educate you about strengthening your portfolio, buying coins, and obtaining other precious metal products.

Historical Rising Price of Gold

When President Nixon moved the United States off the gold standard officially once and for all in 1971 and introduced the fiat financial system, the price for one ounce of pure gold was a mere $35.

In the half century since that time, the price of gold has risen to well over $1800 per Troy ounce, as of December 2020. What other types of assets can you think of which have risen so much in the space of 50 years? While it may not retain that same torrid pace of appreciation over the next half-century, the fundamental appeal of gold prices throughout history is that they are expected to retain their value, even while assets, economies, and nations may suffer around them. In many people’s eyes, gold is relatively stable, it’s reliable, and if you don’t already have some in your portfolio, maybe you should consider it now.

Why investing in Gold?

[2:49 In uncertain economic times, one thing has remained certain: gold always retains some value. Since the first Egyptian dynasty, gold has been revered for its beauty and intrinsic value.

Five thousand years later, gold is still a trusted choice for wealth protection. Gold has stood the test of time as one of the world’s most valued assets.

Emerging economic powers such as Brazil, China, Russia, South Korea, India, and Mexico, are all purchasing tons of gold.

Reasons to invest in Gold

Gold is a time-tested way to protect and preserve a country’s wealth, and it’s no different for individual people with portfolios, who include gold for the very same reasons:

1. Portfolio diversification: Gold is an easy and convenient way to diversify your investment portfolio..

2. Security: – help protect your assets, and be prepared when times change, and the market become volatile.

3. Hedge agains Inflation: Gold has a well-earned reputation for making a great hedge against the inflation that can eat away at the value of paper assets. No matter what happens to gold, it will retain the value that it took to mine and produce it, while paper assets can theoretically go to zero.

4. Political Instability Markets hate uncertainty. Gold is historically known for retaining its value regardless of external political conditions. Whenever there is a political crisis, gold tends to take off. People love the safety that investing in gold delivers.

5. Higher DemandEmerging markets, like highly populated India and China, have increased the demand for gold. Gold typically has a more prominent place in the culture of these types of countries. Gold demand in China has been steady among those who view gold bars as a traditional type of savings. In India, gold is highly valued during the wedding season, increasing the global demand for gold.

6. Gold IRAsGold-based IRAs are becoming increasingly popular these days. Backing your IRA with gold offers excellent protection for your retirement funds when market changes can implode your overall investment portfolio. The gold IRA is a retirement account that is approved by the government and backed by physical gold.

7. Constraints on SupplyMuch of the available gold supply is the result of global central banks selling gold bullion. Generally, when the amount of gold decreases, the price of gold increased.

Bottom Line

If you're ready to diversify and protect your wealth in these uncertain times, we encourage you to reach out to us today. Take advantage of the safe harbor that only gold can provide.

GOLD INVESTMENT PLANS

We have a wide array of investment plans for our investors to choose from.

Choose from the options below the investment plan which best suits you.

Basic PLAN

10%Daily for 30 Days

- Investment: $2,000 - $4,999

- R.O.I: 10% Daily

- Weekly Withdrawals

- Arbitraging Duration: 1 Month

- Referral Bonus: 10%

- 24/7 Support: YES

Enthusiast PLAN

15%Daily for 30 Days

- Investment: $5,000 - Unlimited

- R.O.I: 15% Daily

- Weekly Withdrawals

- Arbitraging Duration: 30 Days

- Referral Bonus: 10%

- 24/7 Support: YES